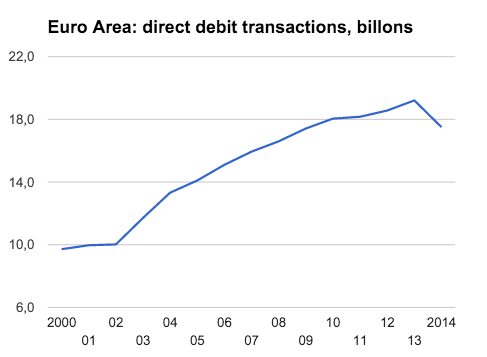

The European Central Bank (ECB) has published Oct 15th the 2014 statistics on non-cash payments. Surprisingly the number of direct debits transactions were declining by almost 12% in the Euro area to 17.8 billion. That was the first time since the ECB is measuring this data:

So let’s have a look where the changes are coming from:

milloins, % are country relative changes, Source ECB

3/4 of the effect comes from Germany 1/4 from Austria. France and Belgium cover for the other countries losses. Slimpay managers told us that growth in France came from checks being banned from some business areas. Especially growth of 69% in Belgium is remarkable. But what happened to Austria with a 50% decline?

Let’s dig a little bit deeper into Germany and Austria. Relative importance of direct debit is melting down:

Some market participants argue credit card transactions are coming back because of lower interchange fees. This might be a valid argument. But it would be much to early to find in 2014 numbers. The contrary is true since also card transactions declined by 8% in 2014 in Germany and Austria.

“SEPA migration failed”

We have asked the Austrian Central Bank for statistical explanation to the 50% decline in direct debit transactions. They seem not to know the reason and doubt that the 2013 numbers where right because they where sourced by a 3rd party, partly wild guessing the figures.

The central bank’s 2014 report does not comment on the issue. The ECB categorizes the Austrian SEPA migration with “minor resolvable issues” which sounds euphemistic. We have to state that SEPA migration or stats failed in Austria. Financial institution did not offer their clients a smooth path to a well working European payment scheme.

But it’s unfair to point at the banking system only. We have observed that merchants and payment service providers where suffering from regulatory uncertainty about how to receive a direct debit mandate. We didn’t see much improvement in direct debit payment solutions in the industry (excluding perhaps Paydirekt, GoCardless and a Stripe balloon test).

Our hope is that we will see a recovery in 2015 and 2016 numbers since the German regulator announced Oct 30 2015 in a FAQ document, that mandates can be received in the future as we know it – with a klick in a checkbox.